We all the time offer OEM or original engine Spare Parts ,all including Pistons, piston rings,

Oil pump, timing wheel, timing belt, tensioner etc.also for Bulldozer Spare Parts ,Wheel Loader Spare Parts ,Motor Grader Spare Parts etc. Welcome your new inquiry!

Cylinder component piston piston piston crankshaft cylinder cylinder head size tile large slim camshaft supercharged water pump oil pump launchers motor connector connecting movement

Diesel Engine Injection Pump,Hydraulic Solenoid Valve,Cylinder Liner Set,Engine Crank Shaft Shandong Ocean Machinery Com.LTD , https://www.sdoceanmachine.com

Intake and exhaust valves, valve oil seals, valve guides,

Rocker arm, rocker shaft, rocker screw,

Camshafts, link rods, link sleeves,

Cylinder block, cylinder head, cylinder liner, cylinder head gasket, oil pan,

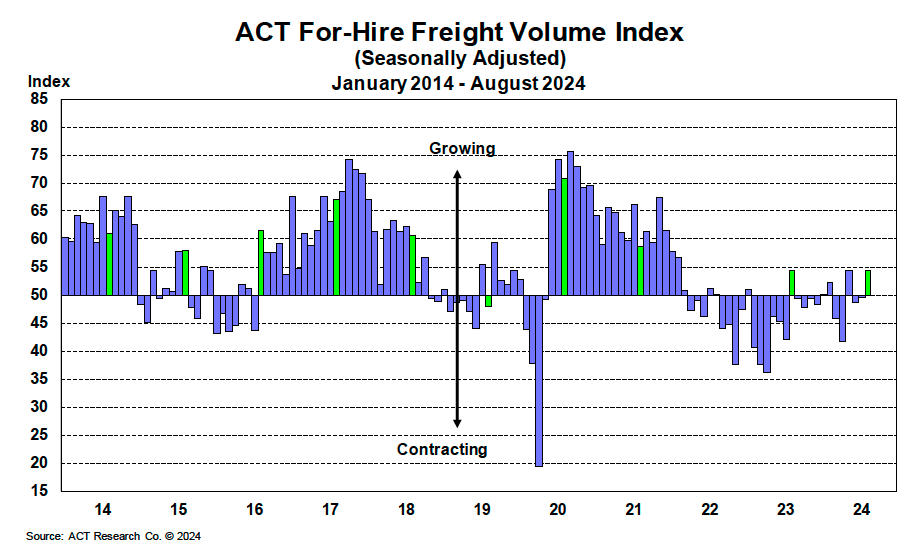

What is Freight Volume?

The surge in economic activity leads to a higher volume of goods that need to be transported. **Freight volume** refers to the total amount of goods, including imports and exports, that move through the transportation system. Almost every physical product manufactured or sold within the U.S. economy passes through the commercial vehicle (CV) market.

**Why Is Freight Volume Important?**

Understanding freight volume is crucial for businesses, regardless of the economic climate. It allows companies to anticipate challenges and seize opportunities. Shippers provide the goods that carriers transport, while brokers act as intermediaries between them. The flow of freight among these players directly affects how each operates. Having accurate data on freight volume helps businesses make informed decisions and plan more effectively.

An effective way to understand supply and demand in the truckload (TL) market is by using the concept of a pendulum. When demand outpaces available capacity—such as when there are not enough drivers or trucks—the pendulum swings in favor of the carriers, leading to rising freight rates. Conversely, when supply grows faster than demand, the pendulum shifts toward the shippers, causing rates to drop. This cycle of fluctuation makes it challenging to align long-term business strategies with short-term changes in freight demand.

**How is Freight Volume Measured?**

For many companies, internal data may not offer a full picture, and gathering broader market insights can be expensive. To address this, ACT Research collects confidential data from a wide range of TL carriers, especially small and mid-sized ones that handle a significant portion of freight in North America. The data includes:

- Trends in business volume

- Market price trends

- Forecasts for vehicle sales and purchases

ACT’s For-Hire Trucking Index surveys carriers to provide a comprehensive view of trends in the transportation and CV markets. In addition, ACT partners with Cass Information Systems, Inc.—the largest processor of freight billing in the country—to gain deeper insights into current market conditions. Using tools like the **Cass Freight Index®**, which tracks freight volumes and spending, and the **Truckload Linehaul Index**, a pricing indicator, ACT helps forecast future freight demand.

**What is ACT Saying Right Now About Freight Volume?**

As of October 2024, freight volumes have remained relatively stable throughout the year, but year-over-year comparisons show signs of improvement. The ACT For-Hire Trucking Index averaged **48.8** in the first half of 2024, up from **42.8** in the same period last year. Despite some consumer pressure, real U.S. retail sales have increased by **1.8% year-to-date**, supported by ongoing disinflation. Additionally, intermodal and import volumes are showing positive trends, contributing modestly to overall surface freight levels.

While private fleet insourcing has likely reduced some demand in the for-hire market, recent declines in U.S. Class 8 tractor sales suggest a slowdown in private fleet expansion.

**Freight Volume Forecasting**

When forecasting the truckload and less-than-truckload markets, ACT Research relies on two key metrics to measure industry demand:

- **Cass Freight Index® - Shipments**

- **ACT Freight Composite Index**

Both metrics reflect consumer demand driving the movement of goods by carriers. In other words, they track the actual volume of freight being transported.

The **Cass Freight Index® - Shipments** measures the number of freight shipments handled within North America by Cass Information Systems. With over $44 billion in annual freight transactions, Cass is a reliable source for tracking shipper activity.

The **ACT Freight Composite Index** estimates the total freight hauled across different sectors, as calculated by ACT Research.

These two demand indicators provide valuable insights into expected freight volumes over the next 6 to 36 months, helping to balance supply and demand when used alongside ACT's capacity metrics.

To learn more about how freight volume is expected to evolve and to access detailed analysis and forecasts for truckload, less-than-truckload, and intermodal markets, visit ACT's freight and transportation forecast.